Overview

Payments Data and Customer Experiences Are Key to Better Loyalty and Rewards Programs.

Mercator Advisory Group’s most recent report, How Payments Can Drive Better Loyalty and Rewards Programs, provides insight into the new technology driving increased personalization and better customer experiences with loyalty programs, and the important role that payment data can play.

Traditional loyalty programs were a source of data for merchants, better enabling them to identify the repeat customers and track the shopping patterns by rewarding their repeat purchases. The digital environment now gives us an abundance of data that is captured in many ways and in many places, moving these programs to become a use of data that provides a better understanding of customer behavior and the more targeted rewards.

Strategic operating decisions that merchants make in key payments areas including orchestration, tokenization, and service provider selection will affect the ability of the marketing team to mine the loyalty data from payments and has the potential to either enhance or detract from the effectiveness of the loyalty program.

“This is a highly relevant and impactful report,” stated Don Apgar, Director of the Merchant Services and Acquiring practice at Mercator Advisory Group, and author of the report. “We are following this among a number of growing trends that are making payments a frictionless and invisible part of our everyday activities.”

This report is 18 pages long and contains 7 exhibits.

Companies mentioned in this report: Experian, Facebook, Fiserv, Paytronix, Radius 8, Starbucks, Stuzo, Yotpo

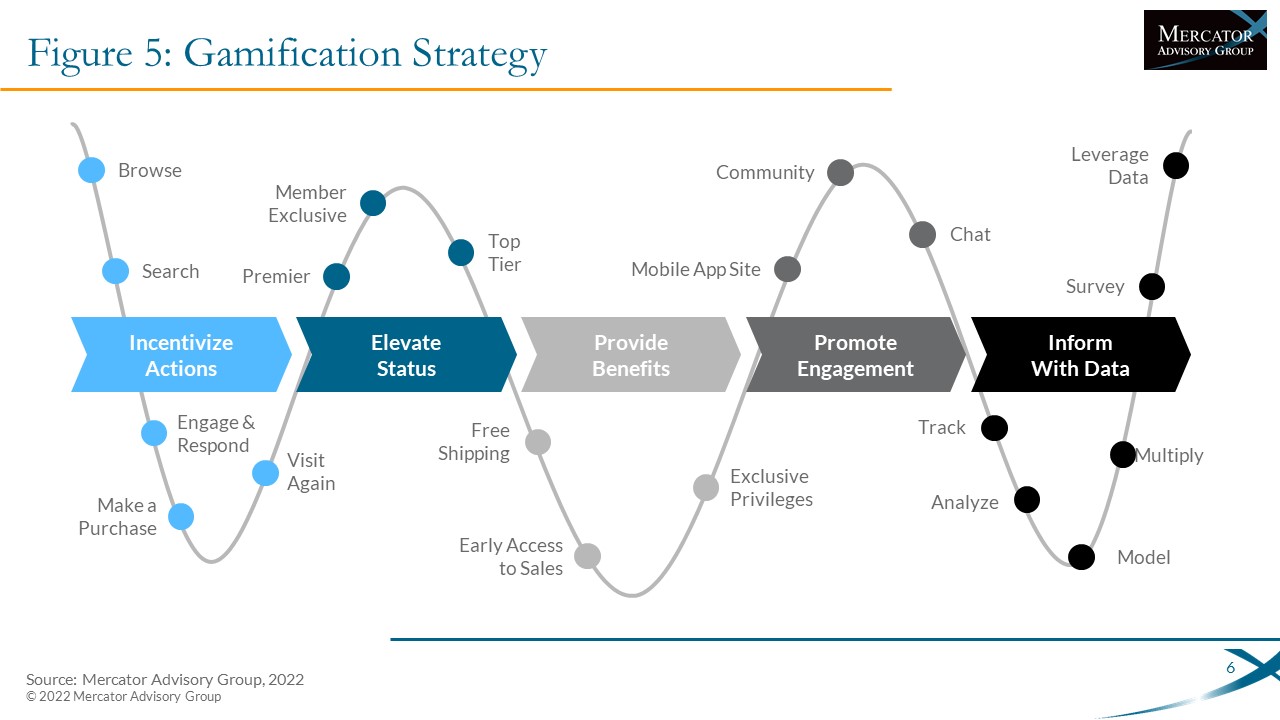

One of the exhibits included in this document:

Highlights of this document include:

- Survey data on participation by vertical market

- Factors affecting loyalty enrollment and participation

- In-depth discussion on the role of data in loyalty programs

- Current trends

- Recommendations for merchants currently operating or considering launching a loyalty program

Learn More About This Report & Javelin

Related content

AI in the Payments Ecosystem

Merchants and payment service providers are working diligently to turn the promises of artificial intelligence into tangible business advantages. AI promises to deliver new levels ...

Agentic Commerce and Merchants: Get Ready for a New Reality—and Some Turbulence

AI-powered agentic commerce could represent a fundamental recasting of the purchasing dynamic, which has always put ultimate decision-making in the hands of consumers. Transforming...

Surcharging on Card Transactions: In Search of Balance

The decision by a merchant to impose a surcharge on credit card transactions—usually a percentage of the purchase price to offset the cost of card acceptance—is understandable but ...

Make informed decisions in a digital financial world